pay estimated indiana state taxes

Pay my tax bill in installments. Indiana Income Tax Calculator 2021.

Access INTIME at intimedoringov.

. Some states also require estimated quarterly taxes. Find Indiana tax forms. To make an individual estimated tax payment electronically without logging in to INTIME.

Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Mail your SC1040ES and payment in one envelope. You can also pay your estimated tax payments using the IRS2Go app.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. You will receive a confirmation number immediately after paying. Staple your payment to the SC1040ES.

How do I pay my Indiana state taxes. Mail your SC1040ES and payment to. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

The Federal or IRS Taxes Are Listed. It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond. Indianas statewide income tax has decreased twice in recent years.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. SCDOR IIT Voucher PO Box 100123 Columbia SC 29202. Select the Make a Payment link under the Payments tile.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Know when I will receive my tax refund. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

Line I This is your estimated tax installment payment. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. Ordinary.

How do I pay estimated taxes for 2020. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. That means no matter how much you make youre taxed at the same rate.

Estimated payments may also be made online through Indianas INTIME website. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Where to mail 1040-ES Estimated payments.

Taxpayers looking for services may dial 2-1-1 to find a nearby VITA location and schedule an. Indiana counties local tax rates range from 050 to 290. Your browser appears to have cookies disabled.

Line I This is your estimated tax installment payment. Make a payment online with INTIME by credit card or electronic check. Line I This is your estimated tax installment payment.

32 cents per gallon of regular gasoline and 53 cents per gallon of diesel. Residents of Indiana are taxed at a flat state income rate of 323. Claim a gambling loss on my Indiana return.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616.

The tax bill is a penalty for not making proper estimated tax payments. You can send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or via your mobile device using the IRS2Go app. Those rates taken alone would give.

081 average effective rate. For a complete list of payment alternatives go to IRSgovpayments. The average income tax rate for counties and large municipalities is 116 according to the Tax Foundation weighted by income.

Take the renters deduction. Follow the links to select Payment type enter your information and make your payment. Cookies are required to use this site.

If you did make estimated tax payments either they were not paid on time or you did not pay. The Indiana Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours.

Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Learn about state requirements for estimated quarterly tax payments. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

This means you may need to make two estimated tax payments each quarter. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with a combined household income of 64000 or less.

Tax Tax Free Income. The Indiana personal exemption includes a 1500 additional exemption for dependent children the exemption for non-minor dependents is 1000. Have more time to file my taxes and I think I will owe the Department.

Your average tax rate is 1198 and your marginal tax rate is 22. One to the IRS and one to your state. Tax Tax Free Income.

All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay. Free Case Review Begin Online. See If You Qualify For IRS Fresh Start Program.

Property Tax Rates Across The State

Property Tax Rates Across The State

Indiana County Income Taxes Accupay Tax And Payroll Services

Indiana Income Tax Calculator Smartasset

Dor Indiana Extends The Individual Filing And Payment Deadline

Indiana Dept Of Revenue Inrevenue Twitter

State Corporate Income Tax Rates And Brackets Tax Foundation

Dor Owe State Taxes Here Are Your Payment Options

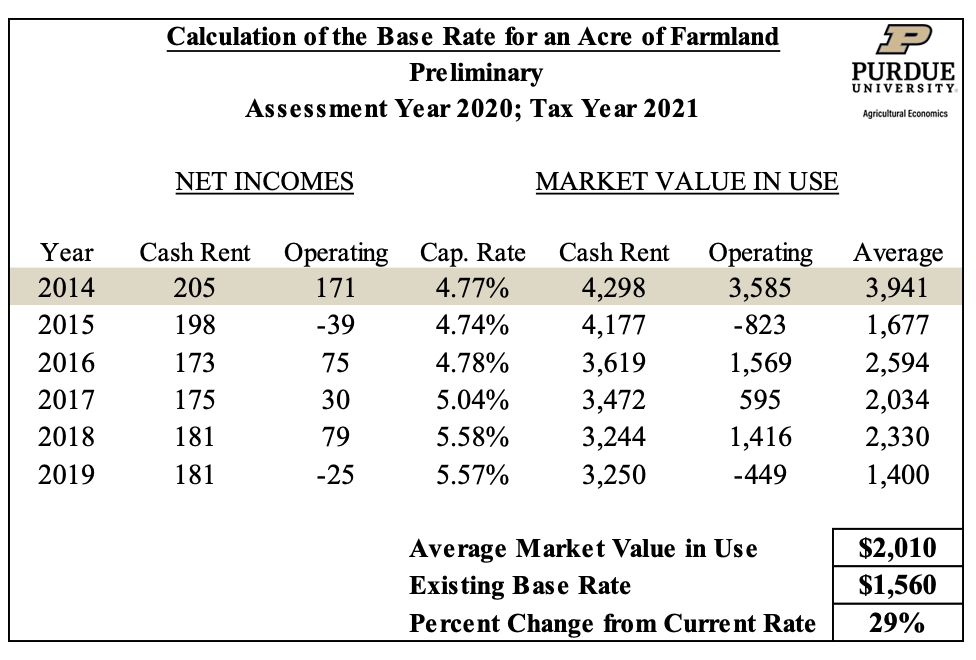

Farmland Assessments Tax Bills Purdue Agricultural Economics

Indiana Sales Tax Small Business Guide Truic

One Source Benefits Infographic Health How To Plan

Indiana State Tax Information Support

Dor Owe State Taxes Here Are Your Payment Options

Indiana Income Tax Calculator Smartasset

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

After The Retail Apocalypse Prepare For The Property Tax Meltdown Meltdowns Tax Lawyer Property Tax